In today’s digital world, reputation is everything. This is especially true in the financial sector, where trust drives every decision. Whether you manage a crypto exchange, an investment firm, a fintech service, or an online brokerage, what people see about you online often determines if they decide to engage or look elsewhere.

In this article, we explore how investors evaluate online reviews, what behavioral research reveals about decision-making in finance, and how financial companies can turn this insight into real business growth.

As outlined in Online Reputation Management in 2025, companies that prioritize transparency through visible, credible feedback are more likely to build long-term trust.

The Real Reason Reviews Matter in Finance

Financial services are built on trust, not just transactions. Clients are handing over their savings, investments, and financial futures. Because of that, reviews in finance carry far more weight than they do in industries like retail or travel.

A single negative review or a lack of visible feedback can easily create doubt, even if the company is completely legitimate. For investors, reviews act as evidence of real performance. They want to see how a firm delivers on its promises in real situations, not just in marketing materials.

Research Insight: How Investors Use Reviews to Evaluate Financial Companies

A 2024 University of Michigan study led by K. Mayo simulated investor behavior in regulated vs. unregulated financial environments. Findings revealed:

- 92% of cautious investors preferred regulated companies that had a visible base of real reviews — even when returns were slightly lower.

- 64% of investors in volatile markets chose reviewed, regulated companies over higher-return but unverified ones.

- 38% of overall decision utility was assigned to regulatory credibility and user feedback in medium-risk conditions.

As emphasized in Best Practices to Manage Reviews in the Financial Industry, the way companies respond to and manage reviews often matters as much as the reviews themselves.

The Types of Reviews That Matter Most

Not all reviews carry the same weight. Financial audiences tend to focus on a few key qualities:

Recent reviews show how the company is performing right now.

Detailed reviews help build confidence because they describe real experiences.

A mix of feedback feels more authentic. A few negative comments show honesty, while the company’s response shows accountability.

Verified reviews build trust by proving that feedback comes from real clients, not bots or competitors.

Reviews that describe service reliability, support quality, or clarity in withdrawal and transaction processes are especially meaningful.

How Platforms Like TrustFinance Help Financial Firms Build Credibility

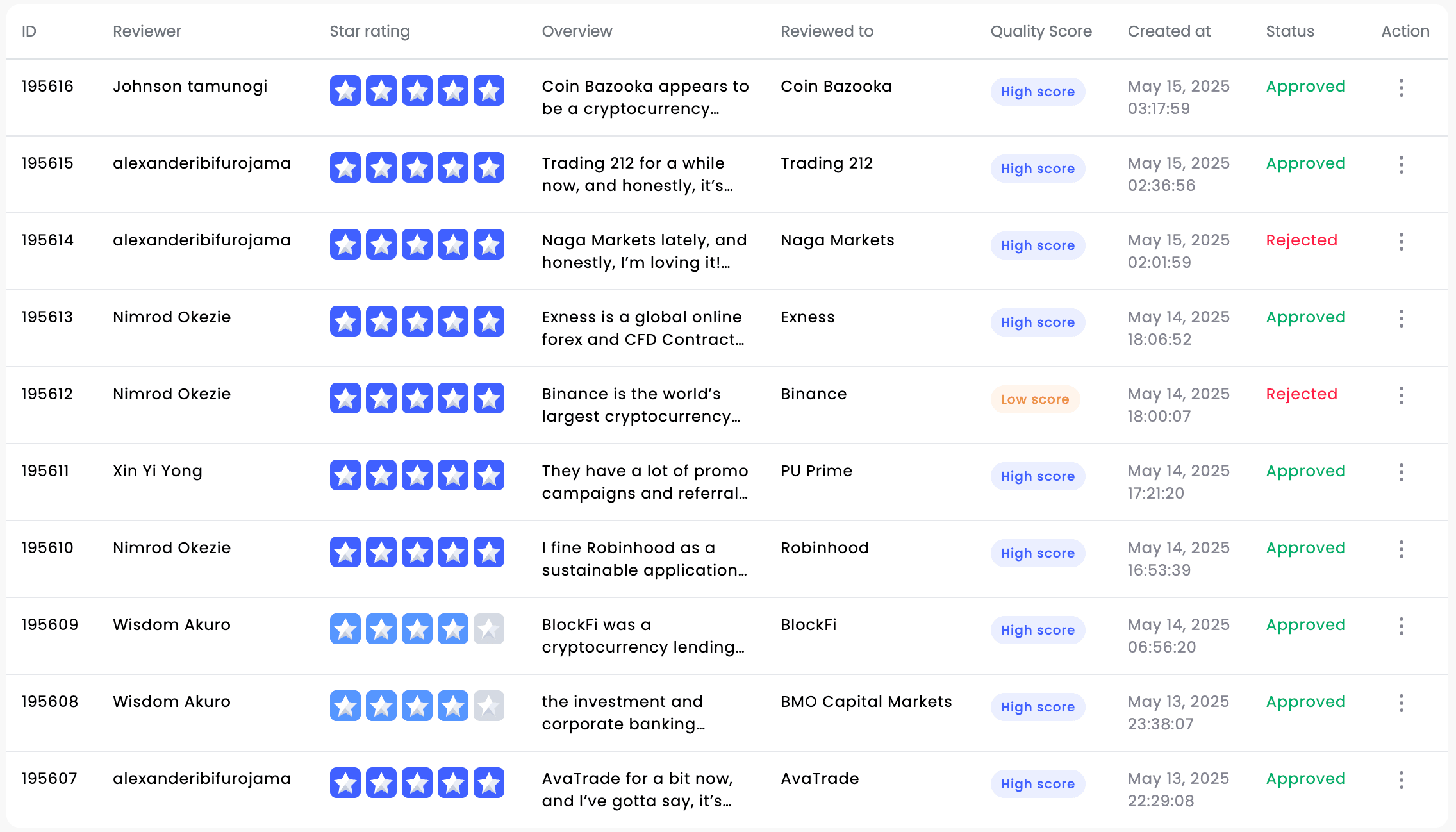

Platforms such as TrustFinance give financial companies a reliable way to collect and display verified reviews. They are designed to protect authenticity while helping firms strengthen their reputation over time.

Verified Reviews

Every review on TrustFinance comes from a confirmed user. Reviewers must verify their email before posting, reducing the chance of fake or spam submissions.

Advanced Fraud Detection

TrustFinance also uses a review-screening system that analyzes language patterns, tone, user connections, and posting behavior. This helps detect fake reviews before they go live.

While no system can block every false review, this multi-layer approach ensures that questionable posts are flagged and real feedback remains visible. As a result, investors can trust that the reviews they read reflect real client experiences.

Key Features for Financial Firms

Custom profile pages that include reviews, licensing details, and company overviews

Unlimited review submissions to show long-term client satisfaction

A transparent TrustScore based on review quality and consistency

Tools that allow companies to reply to feedback and feature positive testimonials

When used correctly, these tools turn customer feedback into a lasting trust asset.

Five Ways to Strengthen Your Financial Reputation with Reviews

Ask for feedback at the right time. Reach out soon after a positive interaction or successful transaction.

Reply to reviews publicly. A thoughtful response, especially to criticism, shows transparency and care.

Show your credentials. Combining verified regulation with visible reviews creates a powerful trust signal.

Keep reviews coming in. Profiles that go months without new feedback can look inactive or unreliable.

Use reviews in your content. Share testimonials on your website, social media, and investor presentations.

As explored in How Customer Reviews Build Trust and Drive Growth for Financial Companies, customer feedback is more than a vanity metric, but a foundation for business credibility.

Final Thoughts: Reviews Are the New Currency of Trust

Today’s investors compare more than just features or fees. They compare trust. Reviews have become one of the clearest signals of reliability in finance.

When financial firms actively collect and manage feedback, they do more than build credibility. They strengthen visibility, attract more cautious investors, and turn transparency into a competitive advantage.

If you are ready to take control of your financial reputation, start by building a culture of feedback. Encourage real reviews, respond to every comment, and let your clients’ voices tell your story.

Ready to take control of your financial reputation? Submit your interest to get listed on TrustFinance