Before diving into the full picture of Asia’s stock market in 2025, it’s important to first understand how to structure a portfolio that can thrive in a year defined by volatility. This year, it’s not just about picking good stocks—it’s about designing a strategy-driven portfolio that helps you survive and grow while most investors remain uncertain.

If you want a clear overview of what an ideal 2025 portfolio should look like, you may want to read this complementary article: Unlock the Secret Code! How to Build a Winning Asia Stock Portfolio in 2025. It will give you a solid foundation that makes the rest of the analysis easier to follow.

Asia’s stock market in 2025 is facing multiple challenges—geopolitical tensions, U.S. tariff policies pressuring exporters, and the Asian Development Bank (ADB) revising economic forecasts downward to 4.7% for developing countries in the region. Despite the seemingly risky outlook, analysts point out that this could be a “golden year for stock pickers.” Investors who can identify companies aligned with global megatrends and backed by strong fundamentals will be able to outperform the broader market in a meaningful way.

Megatrends Shaping Asia’s Investment Landscape in 2025

When discussing investments in 2025, the key question may not be which country will come out ahead, but rather which companies will successfully ride the waves of transformation. Many market reports highlight that global megatrends will remain the central forces shaping Asia’s stock market this year.

Artificial Intelligence (AI) and Digital Infrastructure

AI continues to stand out as the most powerful megatrend, driving Asia’s technology sector. The focus is not only on the applications that users directly engage with but also on the infrastructure behind them—from specialized AI chips to large-scale data centers. These elements are fueling sustained demand in hardware and semiconductor industries, particularly in Taiwan, South Korea, and Japan.

Green Transition and Electric Vehicles (EVs)

Despite global economic pressures, the shift toward sustainable energy remains a central theme. China’s EV market continues to grow, while ASEAN nations such as Thailand and Indonesia are emerging as strategic hubs for EV and battery production, attracting massive FDI inflows. The transition also extends to shipping, with rising demand for dual-fuel vessels aligned with global sustainability standards.

Resilient Domestic Consumption

While external challenges remain, domestic consumption has become a critical buffer for several Asian economies. India is seen as relatively insulated due to its reliance on domestic demand. Japan, meanwhile, is entering a phase of rising wages that is boosting consumer spending. In China, consumer-related services—from tourism to food delivery platforms—continue to demonstrate resilience even amid broader economic headwinds.

Reorganization of Global Supply Chains

Geopolitical tensions are pushing many multinational companies to diversify production away from China. This shift has turned ASEAN and India into key beneficiaries, a phenomenon often referred to as “tariff arbitrage.” As supply chains continue to be reshaped, these regions are attracting greater interest as alternative production bases.

From Megatrends to Companies An Overview of 10 Asian Stocks to Watch in 2025

When viewed through the lens of these megatrends, the focus is not simply on investing in a particular country or industry, but rather on identifying companies whose businesses align with global structural shifts. These may include technology leaders at the forefront of AI, EV manufacturers expanding into new regions, service companies anchored in domestic demand, or firms gaining from supply chain diversification.

From an analytical standpoint, 2025 appears to be less about broad index exposure and more about careful observation of how individual companies position themselves in response to these global forces. Each company has a different capacity to leverage these megatrends, which makes selective attention especially valuable this year.

With this in mind, we highlight 10 Asian companies that reflect the underlying themes of transformation and demonstrate structural resilience. These names are not presented as investment recommendations but as case studies of how certain businesses may stand out in a market environment shaped by AI, EVs, consumption shifts, and supply chain reorganization.

1. Tencent Holdings (00700:HKG)—China’s Digital Titan

Tencent commands an ecosystem of over 1.3 billion users through WeChat. The company is aggressively integrating AI into advertising, gaming, and cloud services, creating new revenue streams. Despite competition, Tencent’s scale and user base make it one of the most powerful players in the Asian tech landscape.

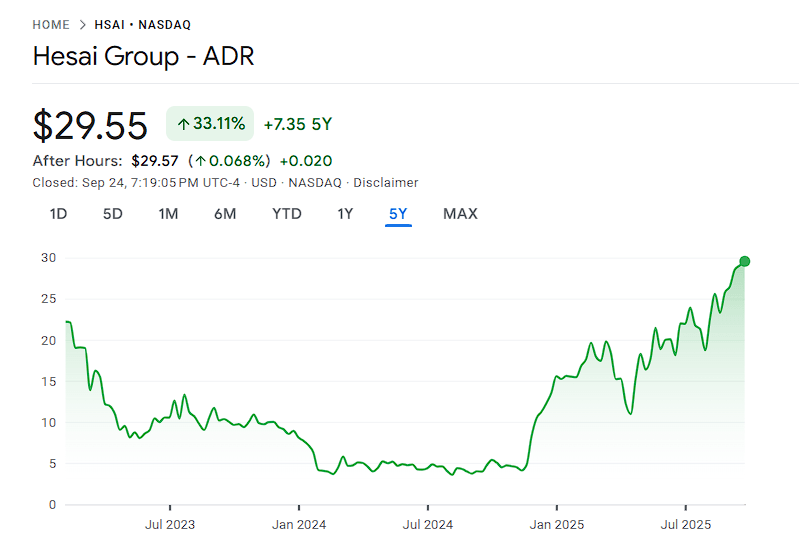

2. Hesai Group (HSAI:NASDAQ)—The “Picks and Shovels” of Autonomous Driving

As the global leader in LiDAR technology, Hesai holds a dominant 61% market share in Level 4 autonomous vehicle sensors. Importantly, the company achieved consistent profitability (Non-GAAP) in 2024, proving its financial strength. With the rise of autonomous driving worldwide, Hesai is well-positioned for long-term growth.

3. XPeng Inc. (XPEV:NYSE) – Smart EV Innovator

XPeng is one of China’s leading smart EV makers, focusing on autonomous driving and AI-powered connectivity. While still unprofitable, analysts forecast a sharp reduction in losses in 2025, with profitability on the horizon. Expansion into overseas markets and government support for EV adoption further strengthen XPeng’s outlook.

4. Fanuc Corp. (6954:TYO)—The Backbone of Factory Automation

Fanuc is the world’s largest manufacturer of industrial robots, holding a 50% market share in CNC systems. It is a key supplier for factories building AI hardware and EVs worldwide. Fanuc’s technological edge and dominance in automation make it a structural growth play with long-term stability.

5. Yangzijiang Shipbuilding (BS6:SGX)—Building the Future of Green Shipping

Listed in Singapore, Yangzijiang has a record order book worth USD 23 billion, securing revenue visibility through 2030. Notably, 75% of its orders are for green or dual-fuel vessels, reflecting the industry’s shift toward sustainability.

6. Sumitomo Mitsui Financial Group (8316:TYO)—A Japanese Banking Giant on the Rebound

SMFG benefits from Japan’s structural reforms, wage growth, and its exit from decades of deflation. With interest rates normalizing, Japanese banks like SMFG stand to gain from improved net interest margins, making them attractive financial plays in 2025.

7. Yum China Holdings (YUMC:NYSE) – The Consumer Champion

As the operator of KFC and Pizza Hut in China, Yum China relies heavily on domestic consumption, insulating it from global trade disputes. The company also announced a USD 3 billion shareholder return plan for 2025–2026, underlining its financial resilience and commitment to investors.

8. Food Moments PCL (FM:SET)—Thailand’s Defensive Agriculture Stock

Food Moments offers one of the region’s highest dividend yields at 8.93%, with a P/E ratio of just 5.4. The company’s strong balance sheet—cash exceeding total debt—makes it a highly defensive pick, attractive to income-focused investors seeking stability.

9. JBM Healthcare Ltd. (2161:HKG) – Healthy Growth, Healthy Dividends

JBM is a leading healthcare products company in Hong Kong, showing strong financial momentum with net income growth in 2024. Dividend yields between 7.5% and 7.8% make it a compelling choice in a sector poised for expansion due to demographic and healthcare demand trends.

10. CNMC Goldmine Holdings (5TP:SGX) – Riding the Gold Wave

As a Malaysian gold producer, CNMC is a direct beneficiary of surging gold prices amid global uncertainty. In the first half of 2025, net profit soared 251% year-on-year, making it one of the region’s standout momentum plays tied to safe-haven assets.

Investment Outlook for 2025

2025 is not the year for a “buy the whole market” strategy. Instead, it’s a year that requires digging deep into the true strengths of each individual company. Technology stocks tied to AI and EV will continue to be major game changers, while high-dividend and defensive stocks will still play a crucial role in balancing portfolios. ASEAN and India are rapidly becoming dominant regional players, driven by strong domestic consumption and large-scale production shifts.

The most effective strategy this year is to build a portfolio that blends growth stocks, cyclical stocks, and value stocks—allowing you to manage risks intelligently while capturing real opportunities in Asia’s evolving markets.

And if you’re looking to add more stability and steady cash flow to your portfolio in a volatile year like this, long-standing high-dividend stocks deserve your attention.

You can explore a curated list of strong performers here:

6 High-Dividend Thai Stocks That Have Paid Consistent Dividends for Over 10 Years

This will give you a clearer view of which companies are resilient enough to withstand market swings while still delivering reliable long-term returns.